Table of Contents

Reverse tax calculation is a useful tool for accounting and financial analysis that enables you to calculate the amount of tax that would be due on a given income. This type of calculation is important for individuals and businesses alike, as it can help them to plan their finances more accurately. By using an Excel spreadsheet to carry out the calculation, it is easy to compare different tax scenarios and make adjustments quickly and easily.

For example, if an individual earns $50,000 annually and lives in a state with a tax rate of 5%, they can quickly calculate their taxes due by entering the income and tax rate into an Excel spreadsheet. The spreadsheet will then calculate the amount of taxes due and the net income after taxes. This allows the individual to easily adjust their budget to account for the taxes due and ensure that they are not overspending.

Reverse tax calculation in Excel is also useful for businesses, as it can help them to easily calculate the taxes due on each sale or transaction. This can be important when planning tax strategies or allowing for different pricing structures. By using an Excel spreadsheet, businesses can quickly compare different tax scenarios and make adjustments as needed.

Overall, reverse tax calculation in Excel is an important tool for individuals and businesses alike. It can be used to quickly and easily calculate the taxes due on a given income or sales transaction, allowing for more accurate budgeting and financial planning.

You can perform a reverse tax calculation to find the price of some item before tax was added.

You can use the following formula to do so:

Price Before Tax = Price After Tax / (1 + Tax Rate)

For example, suppose the price of an item after tax is $14 and you know the tax rate is 7%.

You can use the following formula to calculate the price of the item before tax was added:

- Price Before Tax = $14 / (1 +7%)

- Price Before Tax = $14 / 1.07

- Price Before Tax = $13.08

The price of this item before tax was added was $13.08.

The following example shows how to use this formula to perform a reverse tax calculation in Excel.

Example: Reverse Tax Calculation in Excel

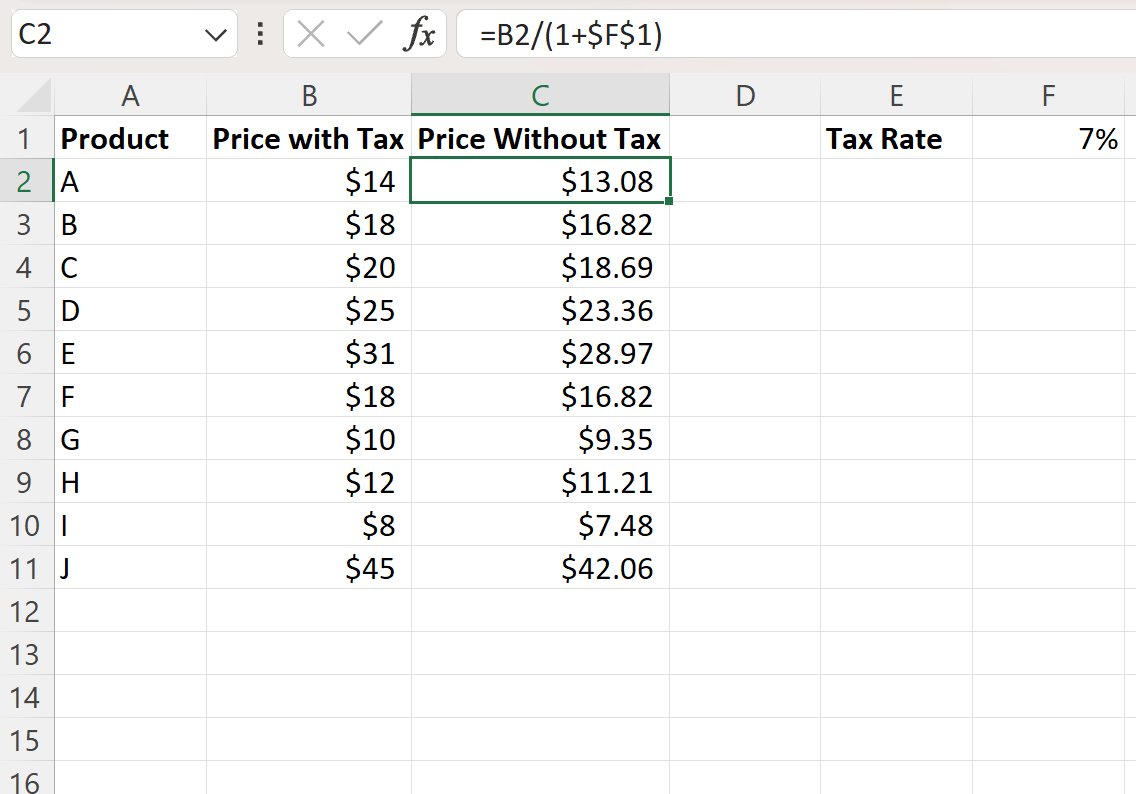

Suppose we have the following list of products in Excel with prices that already have tax added to them:

Suppose we know that the tax rate for each item was 7% and we would like to find the original price of each product before tax was added.

We can specify this tax rate in cell F1 and then type the following formula into cell C2 to find the original price of the first product:

=B2/(1+$F$1)

We can then click and drag this formula down to each remaining cell in column C:

Column C now shows the price of each product before the 7% tax was added to it.

- A $14 product with a 7% tax rate was $13.08 before tax was added to it.

- A $18 product with a 7% tax rate was $16.82 before tax was added to it.

- A $20 product with a 7% tax rate was $18.69 before tax was added to it.

And so on.