Table of Contents

Cross correlation in R can be calculated using the function ‘ccf’. This function takes two vectors, the first being the data of interest and the second being the lagged data, and produces a graph with the correlation coefficient and the lag. The cross correlation can then be read off the graph. Additionally, the ‘cor’ function can be used to calculate the correlation coefficient between two vectors in R.

Cross correlation is a way to measure the degree of similarity between a time series and a lagged version of another time series.

This type of correlation is useful to calculate because it can tell us if the values of one time series are predictive of the future values of another time series. In other words, it can tell us if one time series is a leading indicator for another time series.

This type of correlation is used in many different fields, including:

Economics: The consumer confidence index (CCI) is considered to be a leading indicator for the gross domestic product (GDP) of a country. For example, if CCI is high during a given month, the GDP is likely to be higher x months later.

Business: Marketing spend is often considered to be a leading indicator for future revenue of businesses. For example, if a business spends an abnormally high amount of money on marketing during one quarter, then total revenue is expected to be high x quarters later.

Biology: Total ocean pollution is considered to be a leading indicator of the population of a certain species of turtle. For example, if pollution is higher during a given year then the total population of turtles is expected to be lower x years later.

The following example shows how to calculate the cross correlation between two time series in R.

Example: How to Calculate Cross Correlation in R

Suppose we have the following time series in R that show the total marketing spend (in thousands) for a certain company along with the the total revenue (in thousands) during 12 consecutive months:

#define data

marketing <- c(3, 4, 5, 5, 7, 9, 13, 15, 12, 10, 8, 8)

revenue <- c(21, 19, 22, 24, 25, 29, 30, 34, 37, 40, 35, 30)

We can calculate the cross correlation for every lag between the two time series by using the ccf() function as follows:

#calculate cross correlation

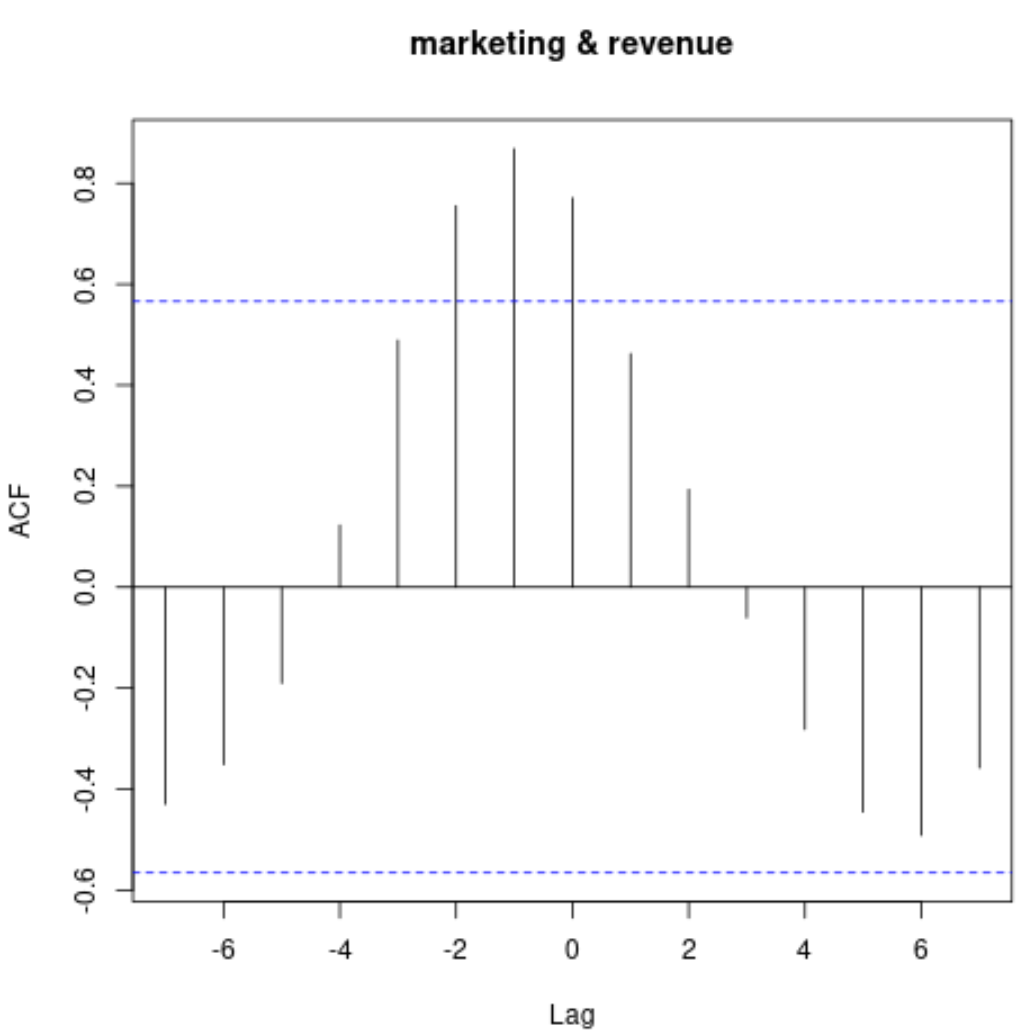

ccf(marketing, revenue)

This plot displays the correlation between the two time series at various lags.

To display the actual correlation values, we can use the following syntax:

#display cross correlation values print(ccf(marketing, revenue)) Autocorrelations of series ‘X’, by lag -7 -6 -5 -4 -3 -2 -1 0 1 2 3 -0.430 -0.351 -0.190 0.123 0.489 0.755 0.868 0.771 0.462 0.194 -0.061 4 5 6 7 -0.282 -0.445 -0.492 -0.358

Here’s how to interpret this output:

- The cross correlation at lag 0 is 0.771.

- The cross correlation at lag 1 is 0.462.

- The cross correlation at lag 2 is 0.194.

- The cross correlation at lag 3 is -0.061.

And so on.

Notice that the correlation between the two time series is quite positive within lags -2 to 2, which tells us that marketing spend during a given month is quite predictive of revenue one and two months later.

This intuitively makes sense – we would expect that high marketing spend during a given month is predictive of increased revenue during the next two months.