Table of Contents

Calculating expected value in real life is the process of determining the average gain or loss of a given situation where the outcome is uncertain. Examples of calculating expected value in real life include calculating expected retirement savings, expected return on an investment, expected insurance payout, expected lottery winnings, and expected salary from a job offer.

Expected value is a value that tells us the expected average that some will take on in an infinite number of trials.

We use the following formula to calculate the expected value of some event:

Expected Value = Σx * P(x)

where:

- x: Data value

- P(x): Probability of value

That formula might look a bit confusing, but it will make more sense when you see it used in the context of actual examples.

The following examples show how expected value is calculated in five different real-world situations.

Example 1: Investments

Expected value is often used by trading firms to determine the expected profit or loss from some investment.

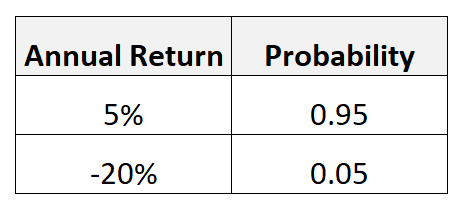

For example, suppose a particular investment is could deliver a 5% annual return with a probability of 0.95, but it could also deliver a -20% annual return with a probability of 0.05.

We would calculate the expected value of this investment to be:

- Expected value = 5%*.95 + (-20%)*.05 = 3.75%

This particular investment has a positive expected value.

This means that if we invested in this particular investment an infinite number of times, we would expected a long-term average annual return of 3.75%.

Example 2: Weather

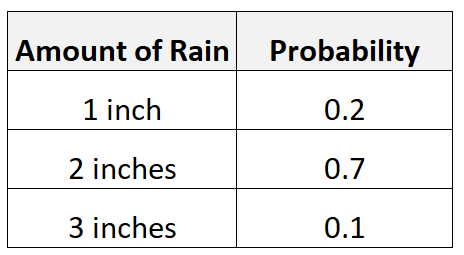

Expected value is often used by agricultural companies to determine the expected amount of rain that will fall during a given season.

We would calculate the expected value for the amount of rain to be:

- Expected value = 0.2*1 + 0.7*2 + 0.1*3 = 1.9 inches

Example 3: Gambling

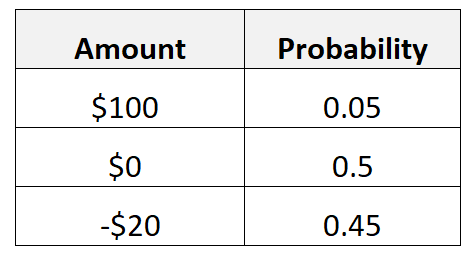

Expected value is often used by gamblers to determine how much they could potentially win at a certain game.

For example, suppose in a certain game there is a 5% chance of winning $100, a 50% chance of winning $0, and a 45% chance of losing $20.

We would calculate the expected value for winnings to be:

- Expected value = 0.05*$100 + 0.5*$0 + 0.45*(-$20) = -$4

This means that if we played this game an infinite number of times we would expect to lose $4 each time we play, on average.

Example 4: Business

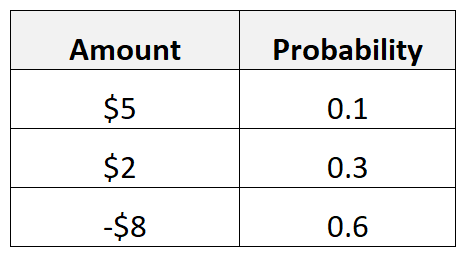

Expected value is often used by businesses to calculate the expected return on advertising spending.

For example, suppose for a particular advertisement there is a 10% chance of receiving a $5 return, a 30% chance of receiving a $2 return, and a %60 chance of receiving a -$8 return.

We would calculate the expected value for the advertisement to be:

- Expected value = 0.1*$5 + 0.3*$2 + 0.6*(-$8) = -$3.70

This particular advertisement has a negative expected value.

This means that if the company used this particular advertisement an infinite number of times, it would expect to lose $3.70 each time, on average.

Example 5: Entrepreneurship

Expected value is often used by individuals when deciding whether or not they should pursue entrepreneurship.

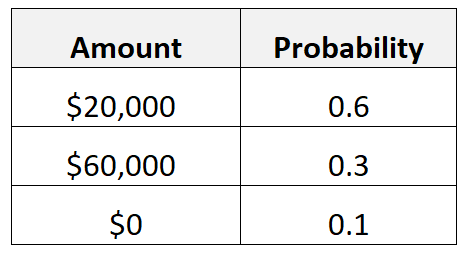

For example, suppose an individuals thinks that if they quit their job and work for themselves that there is a 60% chance they could earn $20,000 in their first year, a 30% chance they could earn $60,000, and a 10% chance they would earn $0.

We would calculate the expected value for their income in the first year of entrepreneurship to be:

- Expected value = 0.6*$20,000 + 0.3*$60,000 + 0.1*$0 = $30,000

Depending on whether or not this amount of money is sufficient, the individual could then choose to remain in their current job or quit.

The following tutorials provide additional information about expected value: